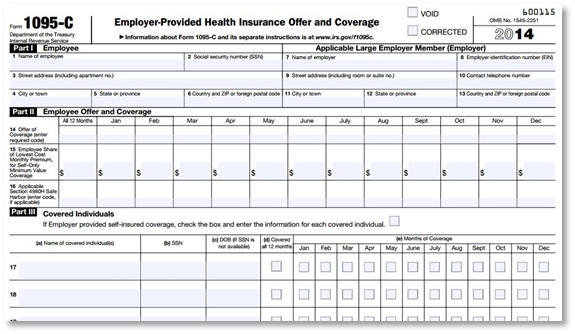

As you prepare to file your 2016 tax return, you will receive a Form 1095-C related to health insurance you may have had or were offered in 2016.

Why will I receive it?

If you receive this form, it is because you:

- Were considered “full time” for ACA purposes for at least part of 2016.

Or

- Were covered for at least a day in 2016 under the NLG-provided, self-insured plan.

How will I use this information?

- You or your tax preparer will use this information to prepare your federal tax return for 2016 to demonstrate you satisfied the ACA’s obligation to have medical insurance.

When will I receive it?

- The forms were mailed last week and you should receive them shortly. You can also obtain a copy of the 1095-C on the National Life Benefits Portal.

- Log into hppts://NationalLife.HRIntouch.com

- Click on “Click Here to View Your Benefits” on the right hand side of the page. (If you do not see the black button, you may need to click on the link under TO DO LIST in the center of the page)

- On the left hand side of the page, click on “View Tax Documents” under MANAGE ACCOUNT.

- You will now be able to download a copy of your 1095-C.