The Payment Center and NLIT are celebrating the retirement of the Check-O-Matic system after a 60-year run.

NLIT News recently shared the story in their latest newsletter.

The Check-O-Matic was National Life’s first system that allowed customers to pay their life and annuity premiums through electronic fund transfers, freeing them from writing checks (and National Life from sending out bills). In its day it was a cutting edge addition to our portfolio!

National Life began offering this automated payment system in 1958 to customers with monthly premiums greater than $10. To incent their participation, customers received 10 cents off each payment. At its inception, fewer than 300 policies were enrolled in Check-O-Matic, and just $11,000 was collected each month through this mechanism.

Check-O-Matic had significant limitations, chief among them its relative inflexibility. Payments could only be accepted on the 1st, 8th, 15th, or 22nd of any month. Two days in advance of any draw date, National Life sent a file to our bank identifying the policyholder bank accounts that were to be drawn from, and the amount to be taken from each account.

This two-day advance notice eliminated any opportunity for customers to make last-minute changes, and as utilization of the system grew, the nightly processing on these four draft dates stressed NLIT’s batch processing.

National Life’s efforts to replace the Check-O-Matic system began in earnest in 2012 with the creation of the superior BankMaster application. By that time Check-O-Matic was taking payments for almost 200,000 policies being administered on multiple policy administrative systems (TRAD, Vantage). The migration was not going to be easy.

The Payment Center and NLIT collaborated to migrate policies from Check-O-Matic to BankMaster in several stages, starting with the simplest case – policies linked to one bank account that did not pay for any other policies. Each subsequent migration involved policies with increasing complexity, which allowed the team to address each new challenge incrementally.

The completion of the migration to BankMaster unifies our acceptance of electronic fund transfers in a single system that accepts transfers on any day of the month, for both life and annuity. BankMaster collects approximately $63 million per month in payments for the 375,000 policies on recurring EFT.

We now have one single user interface to maintain these accounts, regardless of product, system or campus. This is a huge win for the business as it reduces the time to get a new employee fully trained and aligns with our One Company, One Culture initiative.

Finalizing this project also allows NLIT to retire 3 end-user created applications that were developed over the years to provide support for Check-O-Matic processing. This is a welcome step in our Application Rationalization initiative, through which we are replacing older, often unsupported business applications with new, fully supported functionality.

When Check-O-Matic was originally developed, National Life employees maintained a file system with paper index cards for each bank account enrolled in the program. In 1997, when the paper card file had grown to 40,000 cards, Marc Cote created one of these end-user developed applications by migrating that card file into a database. National Life employees celebrated the change as they eagerly destroyed the old card file records.

If you have any questions about the Check-O-Matic conversion please feel welcome to contact Rakesh Kumar at (214) 638-9210 or Shannon Melton at x3128.

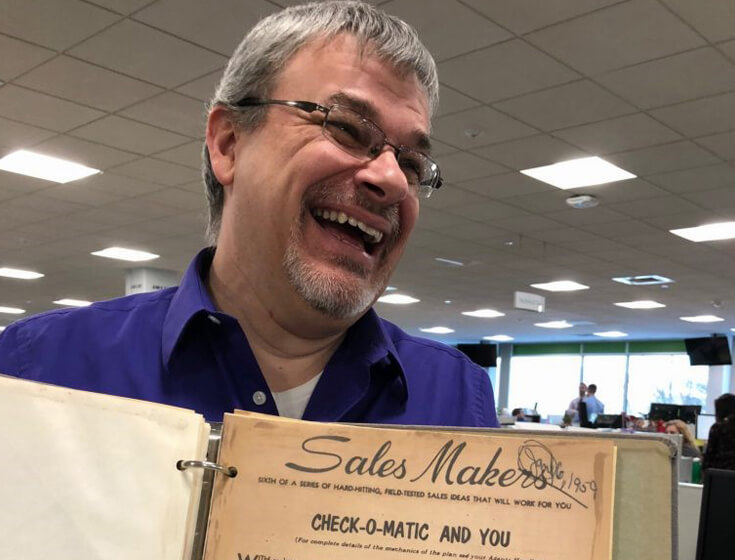

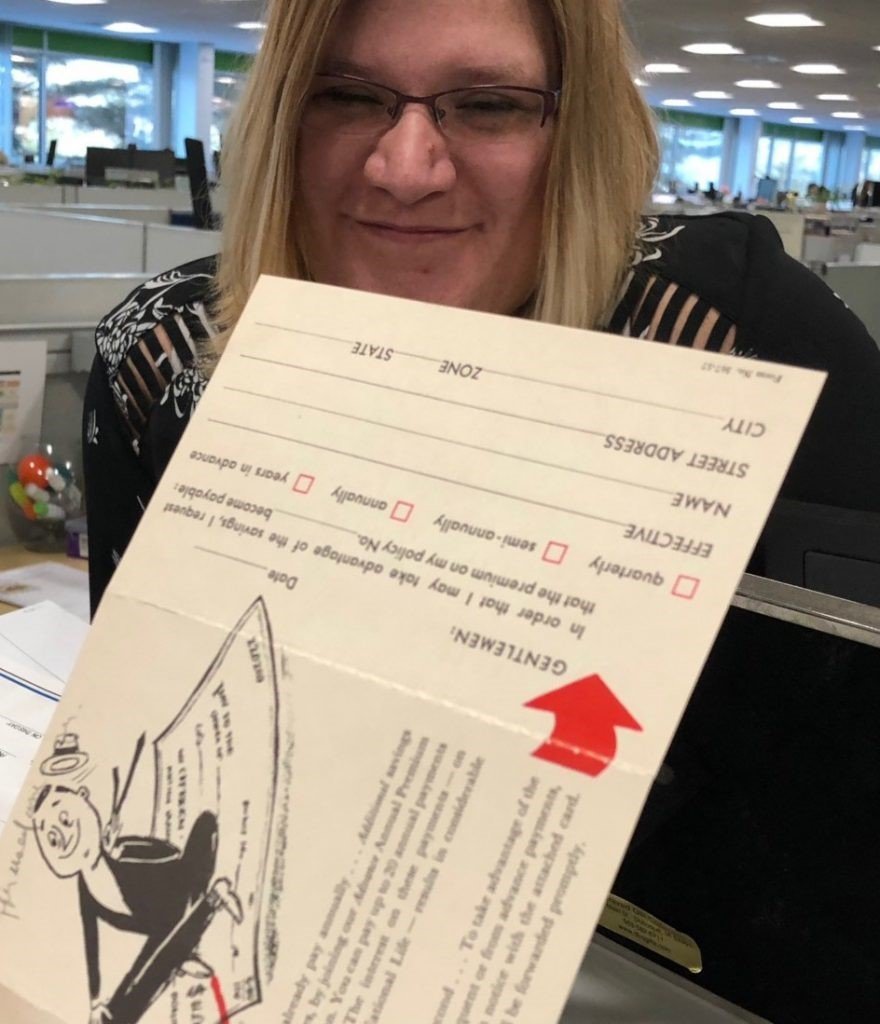

Photos above: A happy Marc Cote holding an old Check-O-Matic Sales Flier and Shannon Melton with original customer request form.