Mehran Assadi and other top executives and business leaders have spent a good part of the past two weeks in Bermuda with our very top producers saluting the work of the past year and what we’ve already accomplished in 2018.

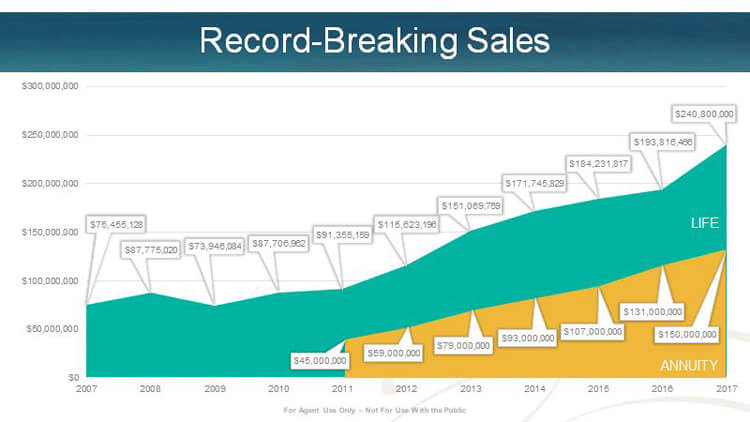

The numbers are pretty familiar to most of us by now, but they bear repeating:

- $241 million in life WNAP

- $155 million in annuity flow

- $737 million in single premium deferred annuity

Check out this chart that Mehran presented to producers to see just how astounding that growth has been.

These are hugely important messages to share with our field because that’s where the numbers are produced. We now have 17,500 producing agents, a 76 percent increase in the number of producing agents in the past five years.

But Mehran also wanted to help put the growth into context about what it means and where it is taking our company as it celebrates its 170th anniversary and the 20th anniversary of our independent distribution channel.

“For National Life, growth is a motivator and a magnetic field that is driving us Due North,” Mehran said.

Mehran stressed that the growth we’ve experienced and project to continue seeing is part of a larger story. Growth, he said, can be intoxicating, challenging, inspiring and powerful even when it can also be trying.

And where is this taking us? What is our Due North? Quite simply, it’s toward 1 million delighted customers.

Today we stand at 805,245 customers and climbing:

- 381,641 annuity customers served in 2017, up 7.5 percent over 2016

- 401,421 life customers served in 2017, up 9.1 percent over 2016.

We’ve set the goal of $300 million of life sales by 2020, $200 million flow annuities and $400 million in core earnings.

As the numbers show, we are moving toward our aggressive goals by focusing on the fundamentals of scalability, customer service, home office talent, technology, and, yes, growth.

“We don’t just want to grow, we want to grow differently,” Mehran said. “We want to keep getting smarter and better – by learning from our customers, engaging with the best talent and leveraging the best technology.”

We shine in serving Middle America, small businesses, K-12 teachers and affluent individuals.

“And when you think about these customers, they don’t fit into neat boxes” Mehran said. “There is connectivity among them. For example, a small business owner may be an affluent individual and a teacher may be married to a CEO or software engineer. So between all of our markets there is a connection and we need to be able to offer them a full set of solutions.”

And we are keeping our promises to those customers. We paid $2.1 billion in benefits in 2017, equaling promises kept that were made many years ago.

There are a lot of numbers here, but they’re worth sharing just to demonstrate how dedicated we are to our cause to Do Good in the lives of our customers. We have strong recurring premium:

- $882 million in life, up 14 percent over 2016 and 71 percent growth over five years

- $409 million annuity, up 11 percent over 2016 and 48 percent growth over five years

- $1.3 billion total, up 13 percent over 2016 and 63 percent growth over five years.

So we are growing well beyond $120 billion of policies in-force.

And finally, Mehran told our agents that it’s important to understand one more set of statistics to appreciate our place in the industry:

- National Life the No. 1 provider of indexed annuities in employer plans and the longest standing insurer. *

- National Life is No. 3 in IUL.

- National Life is No. 17 among life companies

- National Life has paid dividends for 162 years.

All the while, we’re doing even more good wherever we find the chance. We doubled the budget, for example, of the National Life Foundation to $2 million for 2018.

Mehran said he recognizes that every insurance company has the challenge to persuade people to care about life insurance or annuities. He believes there an be a very simple way to achieve that goal:

“Speak to their hearts,” he said. “Recruit more people to our business by recruiting to our cause and our mission. See the future in our shared passion and in the alignment of our values. It lies in our relationships with each other, our families and our customers. It is the Spirit of Us.”

* #17 in life sales — LIMRA Sales Rankings, 2Q2017; #3 in IUL sales — Wink’s Sales & Market Report, 2Q2017; #1 issuer of Fixed Indexed Annuities in Employer Plans — LIMRA US Individual Annuity Industry Sales Report, 2Q2017; Longest standing issuer of indexed annuities in the marketplace — Insurance News Net, FIAs at Age 20, 2015.