It is that time of year to make a decision regarding your bonus.

As in the past, employees can choose if they want a portion of their bonus contributed to their 401(k). New this year, employees who participate in our High Deductible Health Plan with the Health Savings Account, can choose to contribute a portion of their bonus to their HSA.

If you are receiving a bonus in March and would like a portion contributed to the 401(k), you must complete a separate Bonus Election. A maximum of 50% of your bonus can be contributed to your 401(k).

If you are receiving a bonus in March and would like a portion contributed to your HSA, you must make an election for the March 3, 2017 pay period. You can make a maximum of the HSA contribution limits of $3,400 for a single and $6,650 for a two-person or family.

You must make your elections by 3pm, Monday, February 27, 2017. Late contributions will not be processed.

401(k) Bonus Contribution

To set the contribution percentage from your bonus for your 401(k), follow the instructions below or call Prudential at 877-778-2100 for assistance. If you made a bonus election prior to February 1, you will need to make the election again. Any bonus election will not affect your bi-weekly 401(k) amount.

- Log into https://www.retirement.prudential.com/

- Click on the National Life Group 401(k) Plan

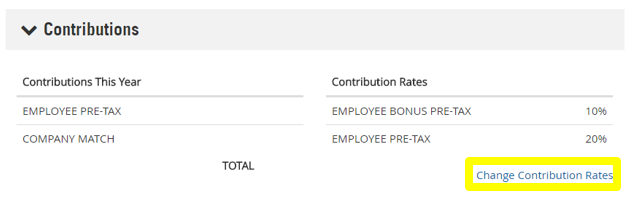

- Click on Change Contribution Rates from the center of the Page

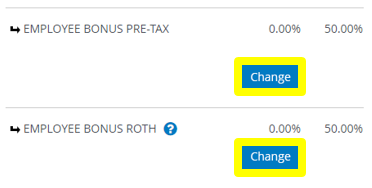

- Click on the change button next to the Employee Bonus Pre-Tax or Employee Bonus Roth

- Change your contribution by sliding the button on the scale or by typing the percentage directly in the box

- Click OK to save the percent you want to contribute towards either Employee Bonus Pre-Tax or Employee Bonus Roth 401k Account.

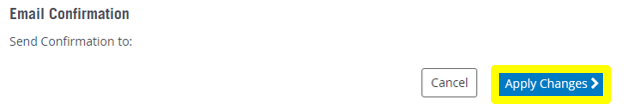

- Scroll to the bottom of the page and click on apply changes to complete the transaction

HSA Bonus Contribution

To set the contribution amount from your bonus for your Health Savings Account, follow the instructions below or call the Benefit Service Center at 802-229-3066 for assistance. If you are already contributing the maximum amount through regular payroll contributions, you will need to change the payroll contribution before choosing the amount to contribute for the HSA. If you are not contributing the maximum through payroll deductions, you will be able to choose an amount that will take you to the maximum allowable.

- Log into https://nationallife.hrintouch.com/

- Click on Enroll Now! on the right hand side of the screen

- Click on the Health Savings Account (HSA) link

- Click on the Edit contribution button

- NOTE: You may need to change your annual contribution if you have already maxed out your contributions for the year. The system will not allow you to add additional contributions above the maximum allowed by law. Click on edit next to your bi-weekly contribution and change the ending paycheck date to 2/24/2017. You will then be able to add the one time contribution from your bonus check and, if you choose, add a new bi-weekly contribution beginning with the 3/10/2017 payroll.

- Click on +Add Contribution

-

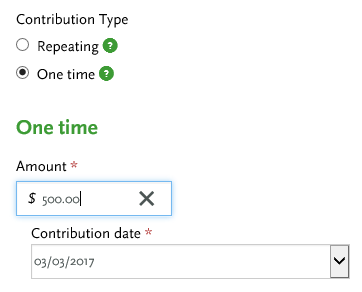

- Click on the radio button for a One time contribution, enter the amount you would like to contribute, and choose the contribution date of 03/03/2017

- To complete the transaction, click on the Add Contribution button

- You are now complete and can exit the system

Remember, you must make this election by 4pm, Monday, February 27, 2017. If you need help with making the change to your 401(k), you can call Prudential Retirement at 877-778-2100. If you need help with making the change to your HSA, you can call the National Life Benefit Service Center at ext. 3066 or 802-229-3066.

If you have any other questions, please contact Lorraine Bishop at ext. 3177 or Michele Granitz at ext. 7161.