Saturday November 13, marked National Life’s 173rd anniversary.

It’s been a long road, but we’ve always been headed for the same destination, even before we articulated our vision: to bring peace of mind to everyone we touch.

As we come around the bend toward 175 years in 2023, we’re driving toward protecting exponentially more people with a goal of serving 2 million customers by then.

It’s an audacious goal, but we’ve shown some audacity in the past 173 years in the name of peace of mind.

Below are a few highlights:

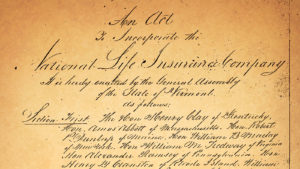

November 13, 1848: Company founders Benjamin Balch, Joseph B. Danforth, Dr. Julius Y. Dewey, Homer W. Heaton, Timothy Redfield and Paul Dillingham chartered under the name, “National Life Insurance Company of the United States.”

1849: Company locates in Montpelier, has first board meeting, bylaws and table of rates are adopted, officers elected, first company prospectus issued. William C. Kittredge is named as President and Julius Dewey, M.D. is named as first Medical Director.

1850: Company moves to its first home at 27 State Street in office space leased from Vermont Mutual Fire Insurance. Benjamin Balch is dismissed and Roger S. Howard is elected secretary.

First policy written, issued to Daniel Baldwin.

1853: Insurance in force reaches $1 million.

1860: Third Home Office building occupied at 116 State Street, where it remained for thirteen years. First policy issued in West of the Mississippi. Insurance in force reaches $2 million.

1861: Civil War begins. Insureds are allowed to serve in the military without policy forfeit.

1870: Insurance in force reaches $5 million, with $1 million in assets.

1873: Fourth Home Office building located at 110 State Street in space rented from Vermont Mutual.

1874: First attempt by corporate raiders to make a hostile takeover of National Life. The effort fails when raiders failed to file in the time frame specified in the bylaws.

1876: Second raid on National Life is attempted, but it was prevented by issuing stock to the directors. Assets reach $2 million.

1877: Emma Dimick is hired as the first female employee in the Home Office.

1880: Benjamin Balch dies in Newburyport, Mass. His many attempts to obtain ownership of the company since his firing in 1850 all failed.

1882: Insurance in force reaches $10 million.

1888: Home Office staff includes President, Vice President, Secretary, Assistant Secretary, Treasurer, Medical Director and three clerks. Assets reach $5 million.

1891: Fifth Home Office building is located at 116 State Street. There are 20 employees. Insurance in force reaches $50 million.

1892: First known year that National Life calendars are issued.

1894: Tag line “Old, Tried, True” first appears.

1897: Actuary Joseph A. DeBoer elected director and secretary. Tag line “The Best Insurance in the World” first appears.

1900: Company celebrates 50th anniversary. Agents’ Association organized with George H. Olmsted of Ohio as the first President.

1901: James C. Houghton is elected President. Insurance in force reaches $100 million.

1902: James C. Houghton dies in Italy. Actuary Joseph A. DeBoer is elected President. Born in Holland, he was a naturalized American citizen.

1905: The first use of “of Vermont” appears on annual report.

1910: Assets reach $50 million.

1915: President Joseph A. DeBoer dies.

1916: Attorney Fred A. Howland is elected President.

1917: United States joins World War I. National Life subscribes for a Liberty Loan to support the war effort in the amount of $315,000. The employees add $30,000.

1918: The company pays more than $1 million on 131 claims during the Spanish influenza epidemic of 1918–19 and World War I. Of those claims, 61 were for soldiers killed in action during the war.

1919: Ellen Putnam, one of the company’s earliest female agents is contracted as an agent with Rochester Agency #036.

1920: A lightning strike sets a transformer inside Home Office #5 at 116 State St. on fire. Smoke rolled out of the rear windows for 15 minutes before the fire was put out by employees with extinguishers.

1921: Committee is formed to search for a new location for the Home Office and ground breaking begins for 133 State Street.

1922: Company moves into new sixth Home Office building at 133 State Street with 209 employees. The company builds a suspension foot bridge over the Winooski River near today’s Bailey Street bridge so employees can reach the company’s recreational facilities at the base of National Life Drive.

1923: Concept of Coleman Mutual Aid Association is created in Coleman, Texas. This eventually grows into Life Insurance Company of the Southwest.

1925: National Life celebrates its 75th anniversary with a book on the company’s history written by Arthur B. Bisbee.

1926: Assets reach $100 million.

1927: 133 State Street suffers heavy damages in basement in 1927 flood. Most archival company documents are destroyed.

1934: First advertisement in National Life’s Historic Art Series appears in Saturday Evening Post and Time magazines. The primary artist is Roy F. Heinrich.

1935: The company begins to actively promote its Vermont roots. The annual report shows “VERMONT” heavily bolded in the logo with a large font.

1937: Elbert S. Brigham is elected President. National Life ad appears in Saturday Evening Post and Time magazines advertising the LIVING BENEFITS of National Life policies.

1938: Retirement plan for employees established on a formal basis. Assets reach $200 million.

1941: War clauses suspended for all policies. Claims are paid on deaths in combat in WWII.

1942: President Brigham announces that due to the war the company will begin working longer hours, including Saturdays. Employee pay was increased to cover the extra time. Assets reach $250 million.

1943: The company begins to use the Vermont coat-of-arms with a “National Life of Vermont” banner as the logo. This was used occasionally until 1948. Retirement plan for agents established.

1944: The Home Office retirement plan was extended to regular salaried workers in agency and loan offices.

1945: Home Office training schools established. Assets reach $300 million.

1946: Mrs. Elva F. Phillips of the Harrisburg Agency is the first female agent to attend a Training School in the Home Office. Insurance in force reaches $740 million.

1948: Ernest M. Hopkins is elected President. First edition of the employee magazine Contact is issued. First appearance of the tag line, “Solid as the Granite Hills of Vermont.”

1949: Insurance in force reaches $1 billion.

1950: Attorney Deane C. Davis is elected President.

1951: Asset reach $500 million.

1952: The National Life Recreation Association obtains a charter from the State of Vermont to open the National Life Employees Credit Union. In 2002 it becomes the Granite Hills Credit Union.

1953: The company begins to again use “of Vermont” on letterhead and other materials. Dora E. Paradee, age 17, of Fairfield, VT purchases policy #1,000,000. Her occupation was listed as “farm girl.”

1954: The company offers 15 acres of the National Life Recreation Field to the City of Montpelier for free if they build a new high school there within two years.

1955: The National Life gold seal logo, introduced in 1954, makes its first significant appearance in the Annual Report. The company considers moving out of Montpelier.

1956: National Life announces the decision to stay in Montpelier, and puts its land for a proposed home office near Burlington up for sale. Insurance in force reaches $2 billion.

1957: Land for seventh Home Office is purchased and construction begins with a groundbreaking ceremony that includes President Deane Davis on a bulldozer.

1958: Governor Joseph B. Johnson pours ceremonial soil into the footings of the main building. The soil came from all 48 states and two territories, including samples from Gettysburg and the Alamo.

1960: The Current Home Office is dedicated and occupied with 550 employees. The “N” in National Life for the large sign on the roof is installed. Originally a red neon sign, the electricity was turned off during the 1973 energy crisis.

1961: The lobby mural by Paul Sample is dedicated. The first electronic “think” machines (computers) are installed on the fourth floor. This was a first in Vermont and was a Remington-Rand Univac STEP computer costing $250,000.

1962: The Coleman Mutual Aid Society, reinsured by the Coleman Life Insurance Company, becomes Life Insurance Company of the Southwest.

1964: Assets reach $1 billion.

1965: Deane C. Davis is named Chairman of the Board.

1966: Dr. John T. Fey becomes President. Insurance in force reaches $4 billion.

1968: Equity Services Incorporated formed. Four members of the Home Office are killed in crash of Northeast Airlines Flight #946.

1969: Deane C. Davis becomes 74th Governor of Vermont serving until 1973. First mainframe computer (RCA) is installed in Home Office. Catherine Burns announces her retirement from National Life after 47 years, second longest in company history to that point. A deal to locate a Howard Johnson’s motel on National Life property collapses, despite tax breaks from the City of Montpelier and low lease rates from National Life. The Hopkins Guest House is built instead. Insurance in force reaches $5 billion.

1973: Pension Department created. Director is Irwin (Bro) Park, Jr.

1974: Norman Campbell becomes President.

1976: National Life Investment Management Co. purchases USLIFE Mutual Funds Management Corp. and renames it Sentinel Advisors.

1977: Richard Fricke becomes President.

1978: National Life’s new main frame computer the Univac 90/80-3 comes online.

1979: Modular office set ups replace lines of desks in the Home Office.

1980: Insurance in force reaches $10 billion.

1981: Three new subsidiaries are formed: Champlain Life, Vermont Life and National Pension Life are incorporated.

1984: Personal computers are first widely delivered to employees’ desks.

1985: Dr. Pat Woolf of Princeton University becomes first woman on the Board of Directors. OMNI II comes online. For the first time, the Field Force can connect to the IBM mainframe from individual PCs. E-mails are called “OMNICRONS.”

1986: Joan Snovich becomes the first female officer of the company when she is promoted to Assistant Secretary of the Corporation.

1987: Attorney Fred Bertrand becomes President and CEO. Insurance in force reaches $25 billion.

1988: The new Davis Building is completed after two years of construction. Pension Department moves and occupies the entire third floor.

1992: Downtown Montpelier floods after an ice jam blocks the Winooski River. The next morning, National Life donates $250,000 to help flood victims.

1993: Eileen von Gal is the first woman to be appointed as Treasurer.

1995: New corporate logo and tag line introduced: “With you wherever the road may lead.” National Life announces the acquisition of majority interest in Life of the Southwest.

1996: National Life website goes live. Board of Directors reaffirms its plan to remain in Vermont.

1997: Pat Welch becomes the new CEO. He makes it clear the company needs to make some dramatic changes in order to survive and prosper.

1998: New “triangle” corporate logo is adopted. The triangles signify the full merging of National Life with LSW.

1999: National Life Holding Company becomes the entity at the highest level of National Life Group. “National Life Group” logo first appears. National Life purchases the remaining one third of LSW.

2000: Insurance in force reaches $40 billion.

2001: Tom MacLeay retires as President and COO. World Trade Center and Pentagon terrorist attack. CEO Pat Welch keeps the company open. Only one person insured by National Life lost their life in the attacks.

2002: Pat Welch announces his resignation to become President of CIGNA Health Care.

2003: Tom MacLeay returns as new Chief Executive.

2005: Insurance in force reaches $52 billion.

2006: Bronze plaque in honor of four National Life agents lost in World War Two is dedicated at a meeting of the General Agents. “National Life of Vermont” sign is removed from the building to be replaced by the new logo and “National Life Group.”

2009: Mehran Assadi is appointed Chief Executive Officer after having served the company as interim Chief Operating Officer and President of Life and Annuity.

2010: New biomass wood chip plant comes on line and begins to heat the Home Office, cutting heating costs in half and reducing the building’s carbon footprint to the equivalent of twelve wood stoves. Insurance in force reaches $62 billion.

2011: LSW Home Office moves to the Millennium Tower in Dallas. Major effort to consolidate all of the many National Life logos into one. At least ten were in current use. Former Vermont Governor James Douglas joins the Board of Directors. CEO Mehran Assadi introduces the new corporate vision statement, “To bring peace of mind to everyone we touch.”

2012: The company rolls out its first national public relations campaign in over 60 years. “LifeChanger of the Year” recognizes educators who are making a positive and lasting difference in the lives of students.

2013: NLG hits a new sales record on Dec. 5 and every new sale through the end of the year sets another new record. Massive ice storm hits Dallas.

2014: 2,000 solar panels are installed on four acres of National Life property off Northfield St. just south of the Home Office. The array provides 500 KW and 15% of the company’s power needs. Insurance in force reaches $83 billion.

2015: Insurance in force reaches $93 billion.

2016: CEO Mehran Assadi is featured on the cover and in the new book CAUSE! by Jackie and Kevin Freiberg. The book focuses on the success of mission-driven companies. “Dear World” portraits campaign launched. Employees have words and sayings written on their bodies to illustrate their thoughts and goals in life. Kim Goodman and Carol A. Carlson become the second and third women to join the Board of Directors. For the first time in company history, three women sit on the board. New record set for both life and annuity flow sales. Assets reach $33 billion. Insurance in force reaches $105 billion.

2017: Sentinel Asset Management is sold to Touchstone Investments. The Paul Sample mural, donated to Vermont Historical Society, opens to the public at the Pavilion Building in Montpelier. Tom MacLeay steps down as Chairman of the Board and is replaced by CEO Mehran Assadi. Insurance in force reaches $120 billion.

2018: National Life celebrates 170 years

2020: The strength of National Life’s culture helps us transform overnight to weather the pandemic, serving our one million customers without missing a beat

2021: At 173, we are more driven than ever to bring peace of mind to more people than ever.